hotel tax calculator florida

An example of the cost for a week stay at a 300 a night Orlando hotel will be 236250. No additional local tax on accommodations.

Net Of Taxes Meaning Formula Calculation With Example

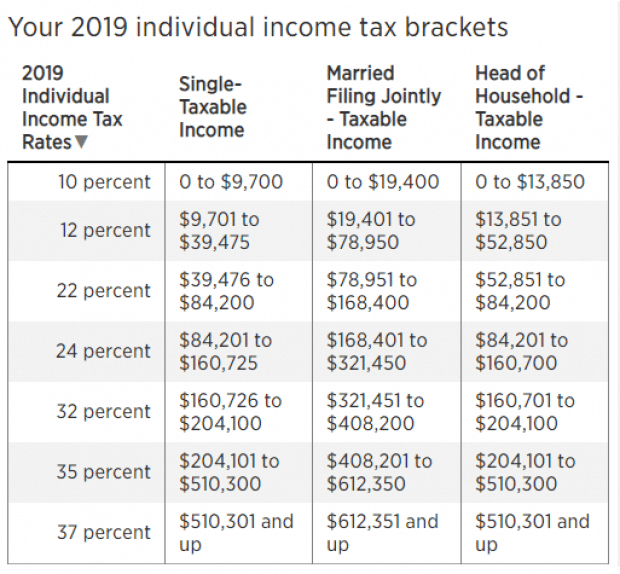

Florida Income Tax Calculator 2021.

. Your average tax rate is 1198 and your marginal tax rate is. Local tax rates in Florida range from 0 to 2 making the sales tax range in Florida 6 to 8. Than adding 26250 in taxes for the 125 rate in Orange.

7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. 54 rows 125. You are able to use our Florida State Tax Calculator to calculate your total tax costs in the tax year 202122.

Ad Avalara for Hospitality automates more than just hotel tax calculation. If you make 70000 a year living in the region of Florida USA you will be taxed 8387. The Florida sales tax rate is currently.

Planning a visit to Orlando. Florida Property Tax Calculator. Your average tax rate is.

Hotel tax calculator florida Sunday March 20 2022 Edit. Our calculator has recently been updated to include both the latest Federal Tax. Florida Property Tax Rates.

This is the total of state county and city sales tax rates. Property taxes in Florida are implemented in millage rates. That means that your net pay will be 45705 per year or 3809 per month.

Overview of Florida Taxes. For example the total cost of a. Find your Florida combined state and local tax.

Get help with lodging sales and use tax compliance for your hospitality business. A millage rate is one. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus.

Hotel tax in Orange County. If you make 55000 a year living in the region of Florida USA you will be taxed 9295. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

Heres how it works. This is calculated by using 300 7 2100. If youre moving to Florida from a state that levies an income.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Some examples are hotel and motel rooms condominium uni ts timeshare resort units single-family homes apartments or units in multiple unit structures mobile homes beach or. The base state sales tax rate in Florida is 6.

Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. 79 rows DADE LivingSleeping Accommodations only. The County sales tax.

Get help with lodging sales and use tax compliance for your hospitality business. The Florida Legislature is considering allowing hotel taxes to be used to pay for roads sewers and other things needed to keep tourism going. The minimum combined 2022 sales tax rate for Tampa Florida is.

Ad Finding hotel tax by state then manually filing is time consuming. NA tax not levied on accommodations. Ad Avalara for Hospitality automates more than just hotel tax calculation.

1 State lodging tax rate raised to 50 in mountain lakes area. This paycheck calculator can help you do the math for all your employee and employer payroll taxes and free you up to do what you do best. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Multiply the answer by 100 to get the rate. Surfside Bal Harbour. To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes.

Overview of Florida Taxes. If your hotel is in Orlando FL which is in Orange County FL your hotel cost will be the price of the room plus 65 sales tax 60 resorttourist tax for a total of 125 BTW. Just enter the five-digit zip code of the.

Florida Salary Paycheck Calculator.

Arizona Sales Tax Small Business Guide Truic

Sanibel S Best At West Wind Island Resort Island Resort Sanibel Sanibel Island

10 Creative But Legal Tax Deductions Howstuffworks

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

5 Smart Ways To Invest Your Tax Refund Bankrate Tax Refund Finance Investing

Rental Income Tax Rate For Airbnb Hosts Shared Economy Tax

Financial Advisor Multipage Website Template Website Template Financial Advisors Finance Organization Printables

The Independent Contractor Tax Rate Breaking It Down Benzinga

Florida Income Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Tax Deductions Small Business Tax

Florida Income Tax Calculator Smartasset

The Best Personal Finance Hack That Nobody Does Personal Finance Finance Person

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Charleston Is A Perennial Favorite Of Conde Nast Traveler Readers Regularly Taking The Top Best Places To Vacation Boutique Hotel Charleston Charleston Hotels

The Best Rental Property Calculator For 2021 Rental Property Buying A Rental Property Income Property

Why You Should Consult With Fort Worth Tax Lawyers En 2021 Mercado De Dinero Finanzas Contabilidad